International Women’s Day was March 8th and I had the good fortune to attend several events to celebrate.

At the Smashing Barriers event organized by TechAlliance, Melissa Sariffodeen, CEO and Co-founder of Canada Learning Code, I was inspired by Melissa’s passion for teaching Canadians of all ages important digital literacy skills that are so vital in today’s workplace. I was also excited to learn that Melissa is a JA alumna, having completed Company Program in London. Another shining example of JA’s impact and outcomes!

At the Wilfrid Laurier International Women’s Day lunch, a panel of experts engaged in conversation around “Women Finding Housing Solutions for a Better Future”. Moderated by by Deborah MacLatchy, President & Vice-Chancellor, WLU, the panelists – Dr. Laura Pin, Acting Director of the Laurier Institute for the Study of Public Opinion and Policy; Jordan Prentice, founder of Kuponya Innovations; Sarah Gillies, Housing Stabilization and Interim Supports Manager, County of Wellington – shared their incredible work, particularly related to policy reform, that they’re undertaking to create a better future for women.

The final event of the week was the Greater KW Chamber International Women’s Day breakfast, where the theme was Inspiring Inclusion. Ren Navarro (B Diversity Group) was interviewed by Regional Chair Karen Redman about how she’s inspiring inclusion in a male-dominated industry.

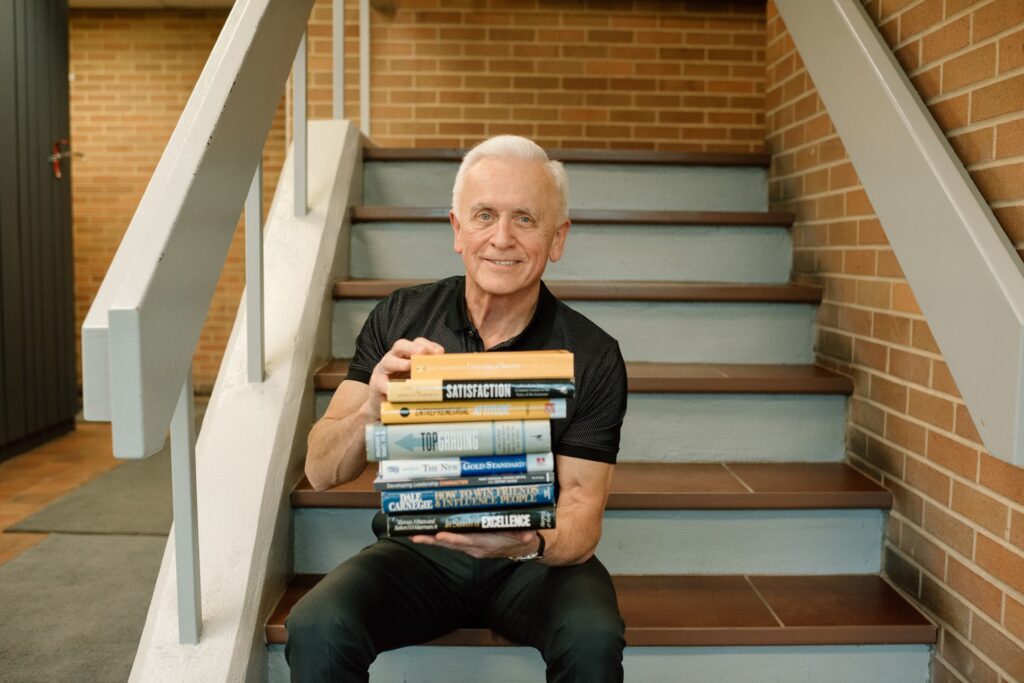

As I reflect on these events as well as on International Women’s Day, I am extremely grateful for those in my life who’ve supported me. There have been wonderful mentors from diverse backgrounds as well as fantastic colleagues who have believed in me. I’ve benefitted from community supports and various programs to help the organizations I’ve led grow. Recognizing how helpful these have been and wanting to provide similar resources to women business leaders – especially our JA students – I’ve compiled a short list of possible resources below. I hope you find them helpful!

- Canadian Chamber of Commerce – Resources for Women in Business

- Government of Canada – Women in Business Guide

- Angel Investors Ontario – Resources for Women Founders in Ontario

- Small business centres across South Western Ontario provide numerous resources, including workshops and courses, to help you launch and grow your business

- Regional Innovation Centres such as TechAlliance (London), Communitech (Waterloo Region), WETech Alliance (Windsor), Boundless Accelerator (Guelph), Innovation Factory (Hamilton) and Innovate Niagara (St. Catharines). Many run programs specifically for female founders.

If any resources come to mind that I may have missed, please let us know at info@jaswo.org. The more we can support female-identifying individuals in their business endeavours and leadership roles, the more we’ll have a well-rounded inclusive society ready to make a difference in the world. Young girls need to see everything their mother, aunts, and family friends can do – and if we all share resources and ideas to lift each other up they will have that chance.

- Karen Gallant

President and CEO

JA South Western Ontario

A new year means a new start and many people consider changing jobs and/or careers in January. It can be a daunting thought for people with work experience, and absolutely overwhelming for a young person who’s just starting out.

A new year means a new start and many people consider changing jobs and/or careers in January. It can be a daunting thought for people with work experience, and absolutely overwhelming for a young person who’s just starting out.