Why RRSP Season Should Interest Teenagers (and How Junior Achievement Supports Early Retirement Planning)

Retirement planning is too often considered a distant concern for teenagers, who are more focused on immediate priorities like school, social activities, and part-time jobs. However, in today’s economic landscape, starting retirement planning early has become increasingly important. With RRSP (Registered Retirement Savings Plan) season in full swing, it’s an opportune moment to discuss why teenagers should take an interest in retirement planning and how organizations like Junior Achievement are supporting youth in this endeavor.

- Understanding Long-Term Financial Goals: Teenagers are at a pivotal stage where they begin to envision their future careers and lifestyles. While retirement may seem far off, establishing long-term financial goals early on can significantly impact their financial well-being later in life. By understanding the importance of saving for retirement now, teenagers can set themselves on the path towards financial independence and security.

- Harnessing the Power of Compound Interest: One of the most significant advantages of starting retirement planning early is the power of compound interest. By starting to save and invest early, teenagers can take advantage of the compounding effect, where their money earns interest on both the principal amount and the interest already earned. This can lead to significant growth over time, even with relatively small contributions.

- Developing Financial Responsibility: Learning about retirement planning at a young age fosters financial responsibility and discipline. By budgeting for retirement savings alongside other expenses, young people develop crucial money management skills that will serve them well throughout their lives. Understanding spending, saving, and investing empowers youth.

- Adapting to Economic Uncertainty: Young people are not immune to the effects of economic uncertainty. As the cost of living continues to rise, without adequate retirement savings, teenagers risk facing financial insecurity in their later years. By starting to save and invest early, they can better prepare themselves to meet future financial challenges.

Note that there is no minimum age to open an RRSP. If a Canadian has employment income and files a tax return, they (or their guardian) may set up and contribute to an RRSP. The same is not true for tax-free savings accounts (TFSAs), which require a minimum of at least 18 years of age.

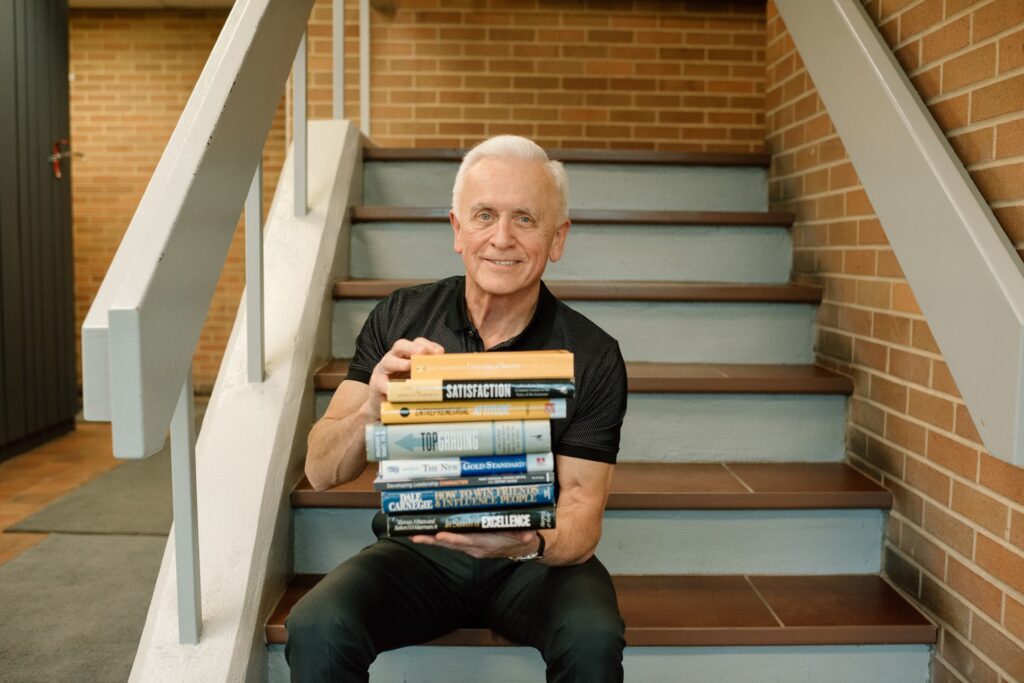

While the benefits of early retirement planning for teenagers are clear, the question remains: how can they access the necessary knowledge and resources to get started? This is where organizations like Junior Achievement (JA) step in.

Junior Achievement is a global nonprofit organization dedicated to empowering young people to succeed in the global economy. One of the key components of JA’s programs is financial literacy education, which includes topics such as budgeting, saving, and investing. Through a variety of learning experiences and resources, JA equips young people with the skills and knowledge they need to navigate the complexities of the financial world.

Through interactive classroom programs such as JA Personal Finance, real-world simulations like JA Investment Strategies, and online resources including JA’s Your Money Questions Answered modules, teenagers learn about the importance of starting early, the different investment options available, and the impact of compound growth on their retirement savings.

RRSP season serves as a timely reminder that retirement planning is not just for adults – even teenagers can benefit from starting to save and invest early. By understanding their own long-term goals, harnessing the power of compound interest, developing financial responsibility, and adapting to economic uncertainty, young people can lay a strong foundation for a prosperous financial future. It is more important than ever for young people to take control of their financial futures, and organizations like Junior Achievement play a vital role in supporting youth in starting retirement planning early, providing them with the knowledge and resources they need to succeed.

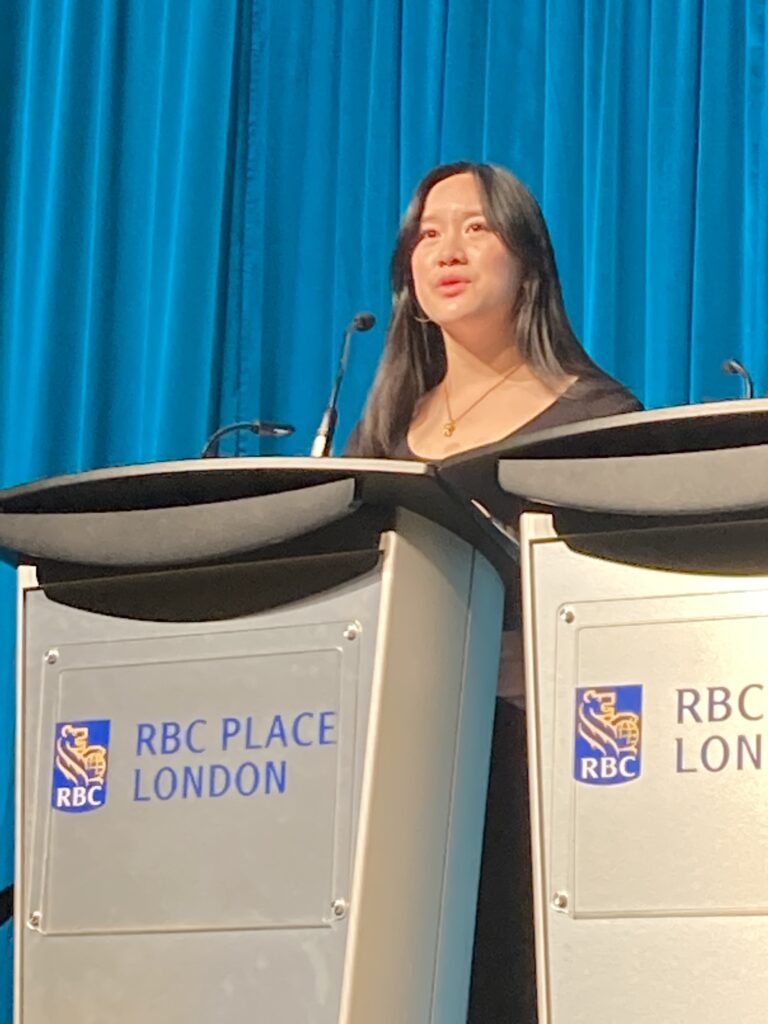

- Karen Chafe

Director, Programs & Operations

JA South Western Ontario