IN THE NEWS: Libro Credit Union is first to invest in Junior Achievement amalgamated charter for greater impact on youth financial literacy

August 25, 2021

SOUTHWESTERN, ONTARIO – Junior Achievement South Western Ontario received a $114,750 investment from Libro Credit Union, setting even more youth up for success with critical life skills that reduce the likelihood of living in debt and ultimately breaking the cycle of poverty.

By amalgamating with Junior Achievement (JA) Waterloo Region, Junior Achievement South Western Ontario now covers the full southwestern Ontario region. Libro Credit Union, a longtime supporter of JA, also serves the same geographic footprint and has partnered with the goal of enhancing delivery of financial literacy learning. The amalgamated charter was announced in a release earlier this summer.

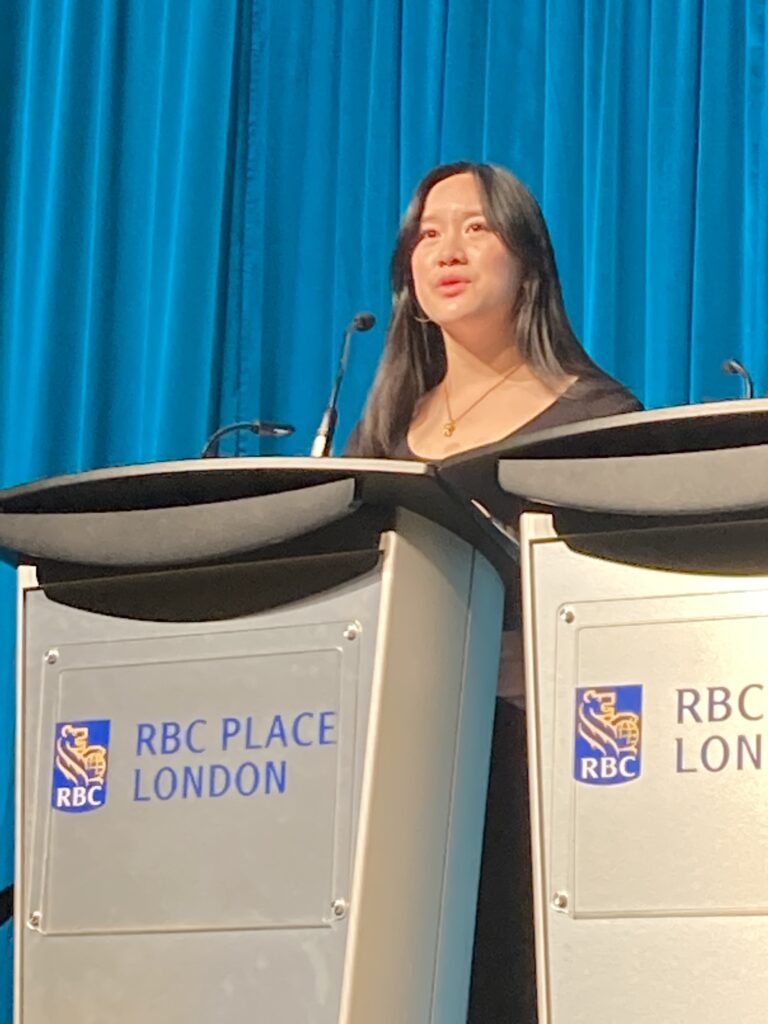

“This support from Libro will provide essential JA education to students across our region,” said Karen Gallant, President and CEO of JA South Western Ontario. “We are thrilled to be working side by side with Libro to inspire the community builders of the future in the towns where they live.”

Libro’s investment will be directed over a two-year period to fund the delivery of 115 financial literacy programs (55 programs delivered in 2021 and 60 programs delivered in 2022) reaching approximately 2,875 students from Grade 4 to high school.

Financial Resilience and Employment are two of Libro’s key focus areas and some of the biggest challenges facing our region. Canadian youth need financial literacy now more than ever.

With the impact the global pandemic has had on our educational system, we can’t lose sight of the essential proactive education students still need. JA has been filling the gap for over six decades and will continue to work with educators and youth to build these critical life skills. The earlier students learn how to manage money, the greater their chances of lifelong financial success.

Recent announcements from the Ontario Government in 2020 and in 2021 indicate that the math curriculum will be upgraded for the first time in 16 years. This will include significant curriculum changes in Grade 9 and mandatory financial literacy learning in Grades 1 through 8, to build valuable money management skills.

JA programs have been supporting youth development in financial literacy, work readiness and entrepreneurship in Canada since 1955. The interactive hands-on experiential learning is age appropriate and engages students with digital tools, resources, relevant content and mentorship from JA trained volunteers.

“Libro has enjoyed a strong partnership with JA for over a decade,” said Shane Butcher, Regional Manager, London-Elgin-Oxford, Libro Credit Union. “We’re looking forward to working with Karen Gallant and continuing our common goal of improving the financial literacy of our youth and developing the next generation of entrepreneurs. Now we’ll have an even greater impact.”

Jordan Moat, Regional Manager, Waterloo, Libro Credit Union adds, “Libro and JA’s aligned values of improving financial literacy and resilience have helped to create an incredible partnership in support of our youth. We’re excited by their recent amalgamation and the synergy this will create amongst our two organizations across southwestern Ontario.”

Libro’s investment will also support the JA London and District Business Hall of Fame and the JA Waterloo Region Entrepreneur Hall of Fame galas, which celebrate local business leaders who have made a positive, lasting impact in their community. These are critical events for the JA community as they inspire the next generation of entrepreneurs and provide connections between Laureates and future leaders.

# # #

https://www.libro.ca/about/media-centre/libro-credit-union-first-invest-ja-amalgamated-charter-greater-impact-youth-financial-literacy