Charitable Giving – It’s Not About the Taxes

When I was in my teens, my grandmother told me that she and my grandfather sent money ‘home’ (to Ireland) as soon as they were married. Grandma Lily had come from Ireland at the age of twelve

on a boat by herself and began working as a housekeeper in the early 1900’s. I could not imagine how much money they would have had when they married. I asked her why they would do this, and her answer was so simple it still brings a tear to my eye today, “We had more than they did.”

I was blessed to be raised by charitable people who consistently gave back. While I am not rich, I too have more than many and believe strongly in being part of the fabric of society that makes it richer.

Seldom over my decades long career have I asked a donor the reason for their generosity to a given charity and heard “it will save me money on my taxes.” Sure, for some donors, the gifts they give certainly impacted their taxable income, but that is not the driving force.

Charity is the ‘benevolent goodwill toward, or love of humanity.’ Nowhere does that mention receiving anything in return.

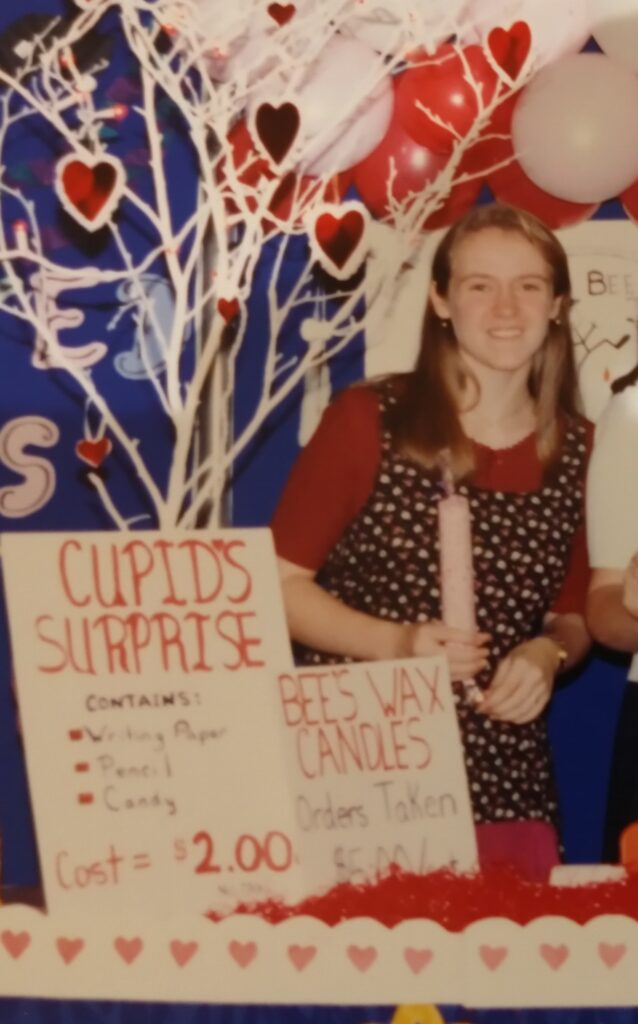

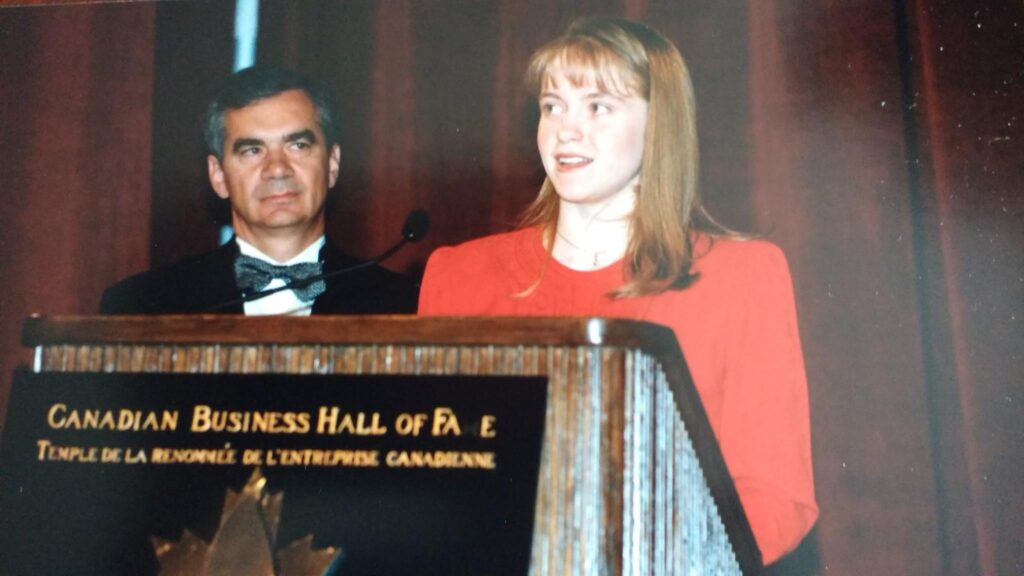

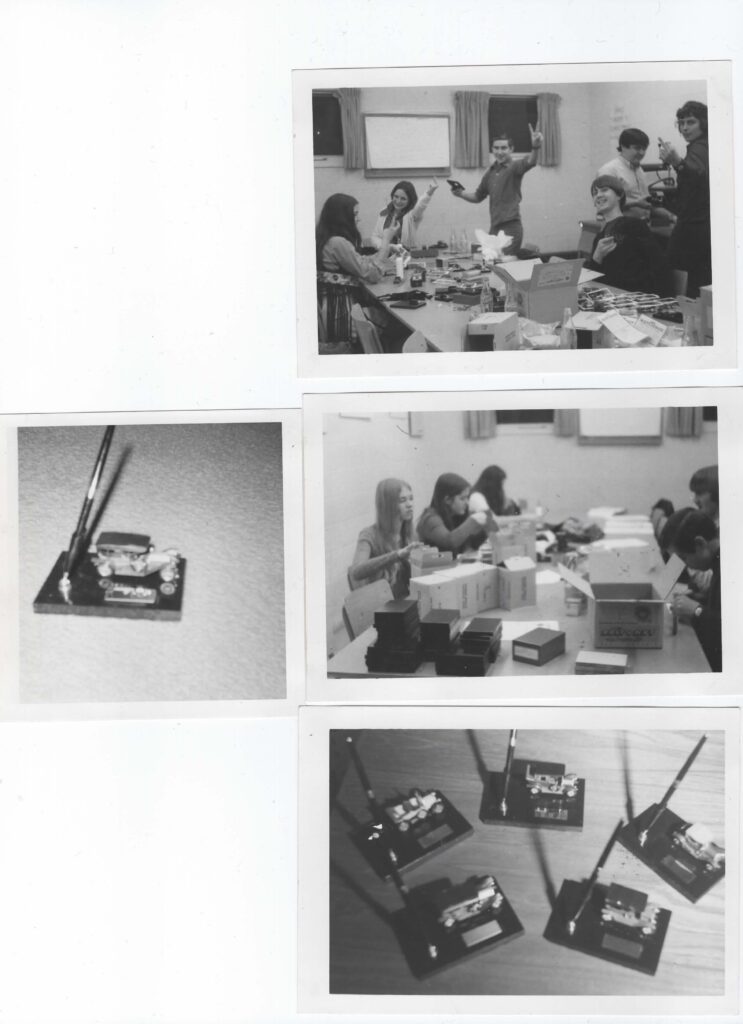

People give to specific causes for many reasons. Often, they have a love of animals, have used that service themselves, i.e. hospital or food bank or are an alumnus i.e. university or Junior Achievement!

But things are getting tougher for non-profits.

According to The Giving Report 2024 – Canada Helps.org, for the eleventh consecutive year, the number of Canadians making charitable donations has decreased.

Over that time, Canada Revenue Agency tax filer data shows donation rates declined from 23.4 percent in 2010 to 17.7 percent in 2021. Similar findings were also highlighted which reveals that giving participation dropped from 82 percent in 2013 to 60 percent in the 2023 survey.

With more Canadians than ever relying on charities for basic needs such as food, shelter, health services, and education the current Canada Post strike is poised to have a direct impact on charities across the country. The Association of Fundraising Professional surveys say that many charities receive at least half of their annual donations during the final three months of the year, with December being the most pivotal month, creating additional challenges for charities.

Charities cannot wait for strikes to settle to deliver on their mission and hope that donors will investigate new methodologies for giving including on-line through the charity’s website, third party platforms such as Canada Helps, or Gifts of Securities through their advisor.

What remains constant is that as the holidays approach, and so too the end of 2024, it is time to reflect on what this year was, and what is possible for the next.

Giving can look quite different for each of us. Financial contributions come in different amounts and for some individuals, gifts of time are the only possibility. Whether it is time, talent, or treasure, every gift you make this holiday season will have an impact on the community you live in. Think about what you want that impact to be.

As Dalai Lama said, “Generosity is the most natural outward expression of an inner attitude of compassion and loving-kindness.”

Here are just a few ideas:

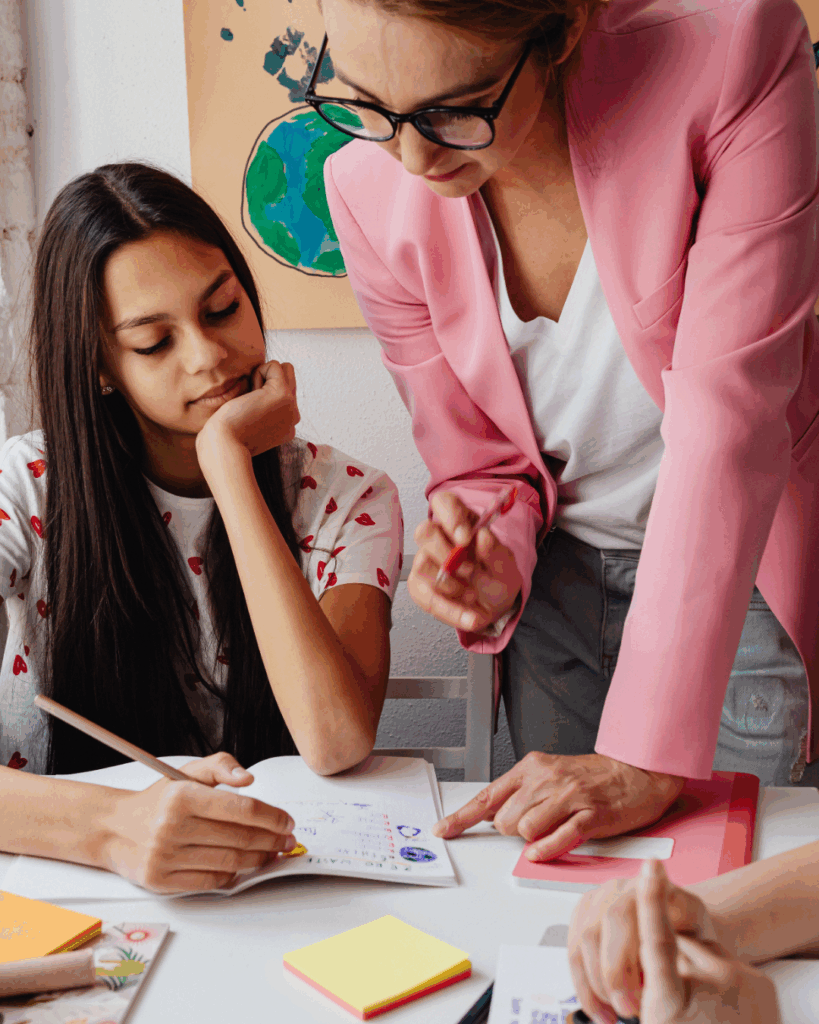

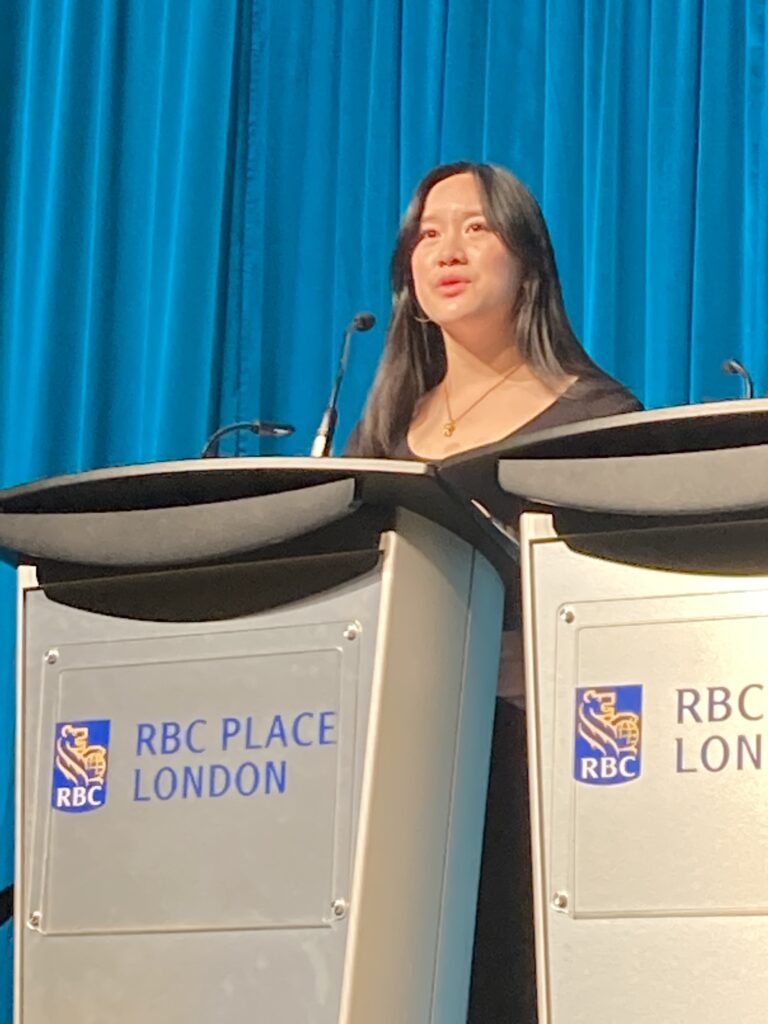

- Sign up to deliver a JA learning experience to a classroom full of eager students either alone or through your company

- Donate to ensure a student has access to a JA learning experience

- Check in on a neighbour who may not have family close by.

- Invite a friend you have not seen for some time out for coffee.

Whatever you choose, I hope that your gift will leave you with a feeling of warmth in your heart.

Wishing you and yours the best of the holiday season.

Heather J. Scott, CFRE

Director, Philanthropy

JA South Western Ontario

The deadline to make a charitable donation to JA South Western Ontario is December 31, 2024. DONATE TODAY.