I remember clearly my first week attending university. I was nervously navigating unfamiliar hallways, classes, and other new realities when I came upon a series of booths set up in the campus food court. Each was a bank or other financial institution vying for my attention and sharing the opportunity to sign up for my very first credit card. My reaction? No way! My impression at the time was that credit was bad and should be avoided at all costs. Money was not a topic I had the opportunity to learn much about in school and I had little exposure to the benefits of having a credit card and using it responsibly to help build my personal credit.

November is Financial Literacy Month in Canada, a time to bring attention to the importance of developing strong money awareness and positive money attitudes and to help Canadians manage their money and debt wisely, save for the future, and understand their financial rights. This is especially important for young people who are just beginning to develop knowledge and perspectives related to money. It is even more important now, at a time when rapid inflation, rising interest rates, and other economic influences have amplified the financial challenges faced by many, especially those with vulnerabilities.

But where does responsibility for financial education lie?

For many, the greatest source of financial information and learning is at home. Parents play a significant role in laying the foundation of financial readiness and resilience for their children. However, according to a 2021 survey conducted by TD, one in three Canadian parents aren’t confident they’re setting a healthy financial example for their children, and only about 10 percent of parents consider their household to be in “excellent financial health”. According to the National Financial Literacy Strategy 2021-2026, the Financial Consumer Agency of Canada (FCAC) has conducted a survey and found that only 61% of Canadians could correctly answer five of seven financial literacy questions. If we rely solely on the home to provide these valuable lessons, we run the risk of perpetuating the same level of financial literacy that currently exists with little opportunity for improvement.

The Ontario Ministry of Education has recognized the need for financial education to also take place in schools and has introduced curriculum outcomes linked to financial literacy at several places throughout a student’s K-12 education. There is mandatory learning about financial literacy now embedded in Grades 1 to 8 Mathematics, in the Grade 9 Mathematics course, and in the Grade 10 Career Studies Course. In 2023, the Ontario Ministry of Education also made available three self-guided learning modules for high school students available through the ministry’s website. These are very positive steps toward ensuring young people have every opportunity to improve their financial readiness.

Organizations like Junior Achievement (JA) South Western Ontario also strive to equip young people with the skills and attitudes needed for lifelong success when it comes to money matters. JA offers learning experiences that can be facilitated by teachers or community volunteers or completed independently by students online. These experiences support and reinforce the curriculum outcomes taught in schools and the lessons learned at home.

The reality is that we all bear responsibility in the effort to better equip young people with financial confidence and resilience. Families, schools, and communities working together will provide the best possible combination of knowledge, skills, attitudes, and experiences for young people. Programs that are interactive, interesting, and relatable to students will help them see the importance and enable them to apply the learning to their own lives. As a result, young people will be ready to navigate the financial challenges ahead, assessing their options intelligently and making good decisions with confidence.

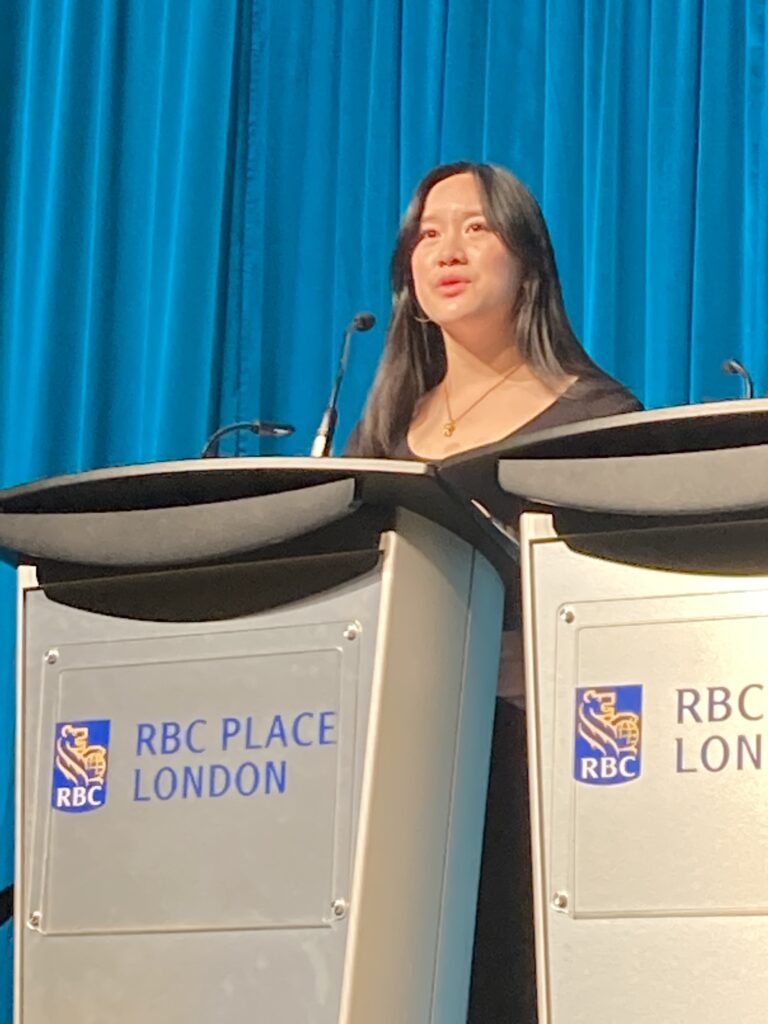

- Karen Chafe

Director, Programs & Operations

JA South Western Ontario

About the Author

A proud aluma of the JA Company Program, Karen Chafe has worked with JA for over 11 years and is currently Director, Programs and Operations for JA South Western Ontario. Karen is a former high school mathematics teacher and is passionate about providing youth with impactful learning experiences.

Karen Chafe